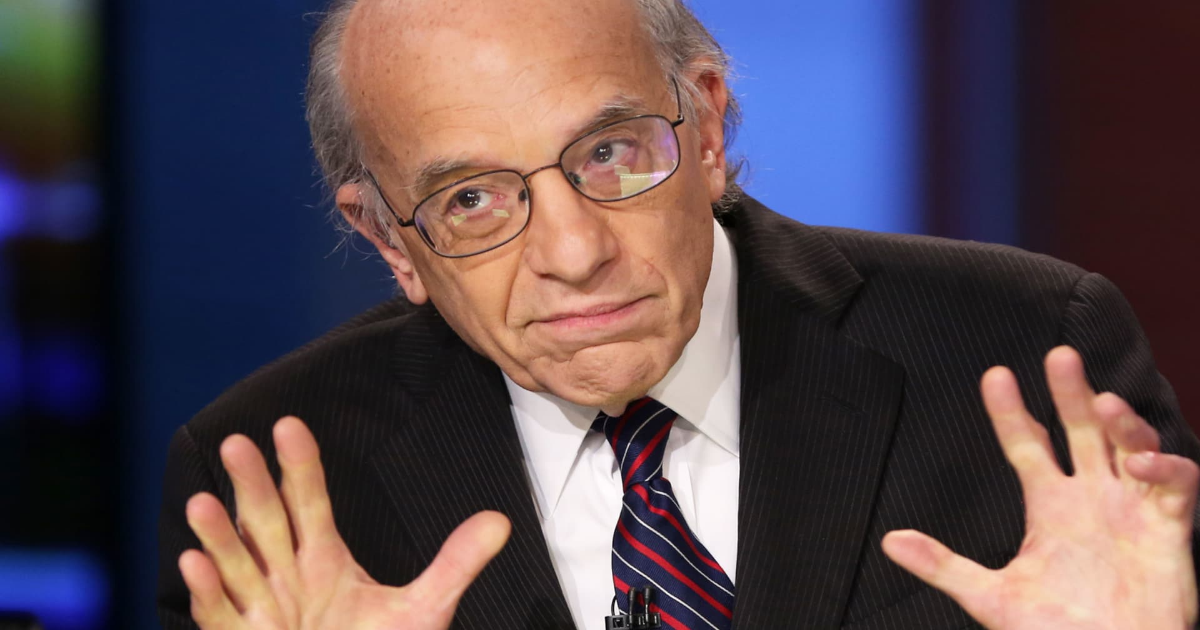

President Donald Trump’s recent sweeping tariffs policy could be a worse move for the U.S. than the Smoot-Hawley Tariff Act of 1930 , according to Jeremy Siegel, professor at University of Pennsylvania’s Wharton School. “I think this is the biggest policy mistake in 95 years,” Siegel said Friday on CNBC’s ” Squawk Box .” “I don’t know why Trump didn’t learn the lesson of the Smoot–Hawley Tariff [Act], because I know the [Federal Reserve] learned the lesson of its mistakes in 1930, ’31 and ’32. That’s one reason why the great financial crisis did not turn into a Great Depression. We flooded the banks with liquidity, which we did not do 95 years ago.” “This is a self-inflicted wound. It’s an unforced error – did not have to happen,” he continued. His remarks come after the stock market sold off Thursday on the heels of Trump imposing a 10% baseline tariff on almost all countries as well as much steeper tariffs on others, such as a 34% tariff on China, a 46% tariff on Vietnam and a 20% tariff on the European Union. Along with the S & P 500 returning to correction territory, the session saw the Russell 2000 index enter a bear market . In early trading Friday, stock futures dropped sharply after China retaliated with a 34% tariff on all goods imported from the U.S. , effective April 10. Futures tied to the Dow Jones Industrial Average faced another 1,000-point drop, while S & P 500 futures also lost more than 2%. Nasdaq 100 futures plunged 3%. “If you’re a long term investor, you’re staying in the market,” Siegel said. “If you’re a trader, there are storms ahead as long as these tariffs remain.” The Wharton professor added that there will be “brighter days” at some point in the future, as he believes the tariffs “won’t last forever.” However, he stressed that the chance of a recession is now more likely, noting that uncertainty surrounding the tariffs “will reverberate for a number of years in the economy even if two weeks from now he removes it.” “If these stay on, I think the probability of a recession has probably moved above 50%,” he said. “If he removes it, we won’t have a recession. We’ll have a slowdown.” Trump has said that he’s open to tariff negotiations with other countries. That’s even after multiple White House aides have insisted that the tariffs weren’t a negotiating tool. “If we did eliminate all tariffs … we would still have the U.S. [with] a trade deficit with the rest of the world, and so this idea that … is stuck in Trump’s head that a trade deficit is inherently bad is just absolutely wrong on every single measure,” Siegel noted. As a result of the tariffs, the professor forecast lower interest rates and higher inflation, pointing out that he had previously thought there was “no chance” of a cut at the Fed’s meeting in May. The chances of that happening have also “increased dramatically,” he believes. Traders have currently priced in a more than 58% chance of no interest rate cut next month, while the odds of a quarter-percentage-point cut sits at more than 41%, according to CME’s FedWatch tool .