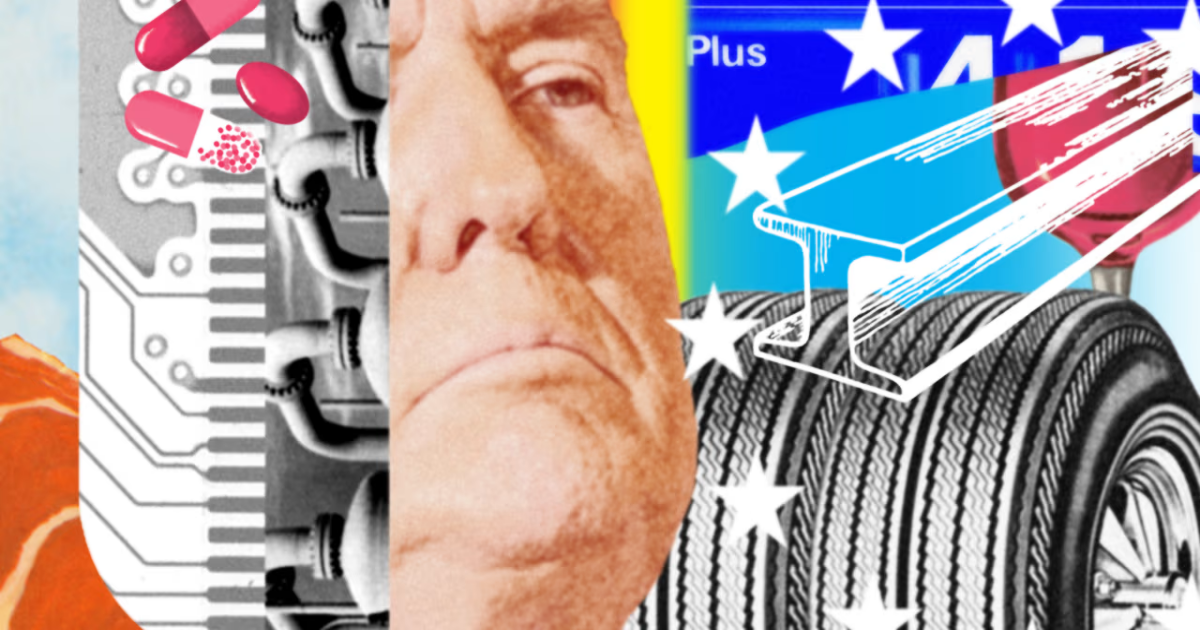

China lashed back at President Trump’s tariffs, applying 34% levies on all imported goods from the U.S. Beijing said the levies would come into effect next Thursday, the day after a big part of Trump’s promised tariffs go live. “China played it wrong, they panicked,” Trump retorted.

The market selloff continued Friday, with the China retaliation and recession fears pushing investors to sell stocks and hide in the safety of government bonds.

Marco Rubio, Trump’s secretary of state, acknowledged that “markets are crashing” but said economies weren’t, and that global businesses would adjust to the new environment. Trump said investors were pouring money into the U.S., saying in a social-media post it was a “great time to get rich.“

Investors, however, drew some solace from an unexpectedly strong jobs report. That showed the economy added 228,000 jobs last month, giving little sign that uncertainty ahead of Trump’s tariff rollout had derailed the labor market.

Major U.S. indexes all dropped more than 3% in morning trading. The Nasdaq Composite was on pace to close in a bear market, meaning it has fallen more than 20% from a recent peak. Overseas markets took fresh hits, with European stocks tumbling more than 4%.

Investors rushed into Treasurys, pushing 10-year yields well below 4%. Bonds in other big economies, like Japan, Germany and the U.K., also rallied. Bond yields fall as prices rise. The dollar, which fell sharply Thursday, rebounded somewhat but remains near its weakest levels of the year.

A speech on the economic outlook by Fed Chair Jerome Powell is slated for 11:25 a.m ET. The big question: How will tariffs and the market mayhem feed into future rate decisions?